The Birth of the Web 3.0 Rollup

Many of the first generation of large internet properties – often termed Web 1.0 (in my mind roughly 1998-2007) – were holding companies employing roll-up strategies, acquiring and aggregating multiple brands. Everything from IAC’s (NSDQ: IAC) entry into digital media, to GSI Commerce, Liberty Media Group, even XOXO Group (NYSE: XOXO). The purpose, in many cases, was to become a category killer – not simply operating a single product, or targeting a specific demographic – but owning an entire category: fitness, makeup, weddings, holidays, etc. The years that followed brought a host of unbundling. Entrepreneurs recognized the underleveraged value that could be unlocked by catering to specific groups of customers within platforms such as Craigslist or eBay. This trend brought us Airbnb and Etsy but also lots of single purpose or vertical/niche specific apps that failed to reach venture scale. I wrote about this recently in The Market Has Spoken: Go Horizontal not Vertical. But it was unclear to me at the time what those horizontal extensions might look like.

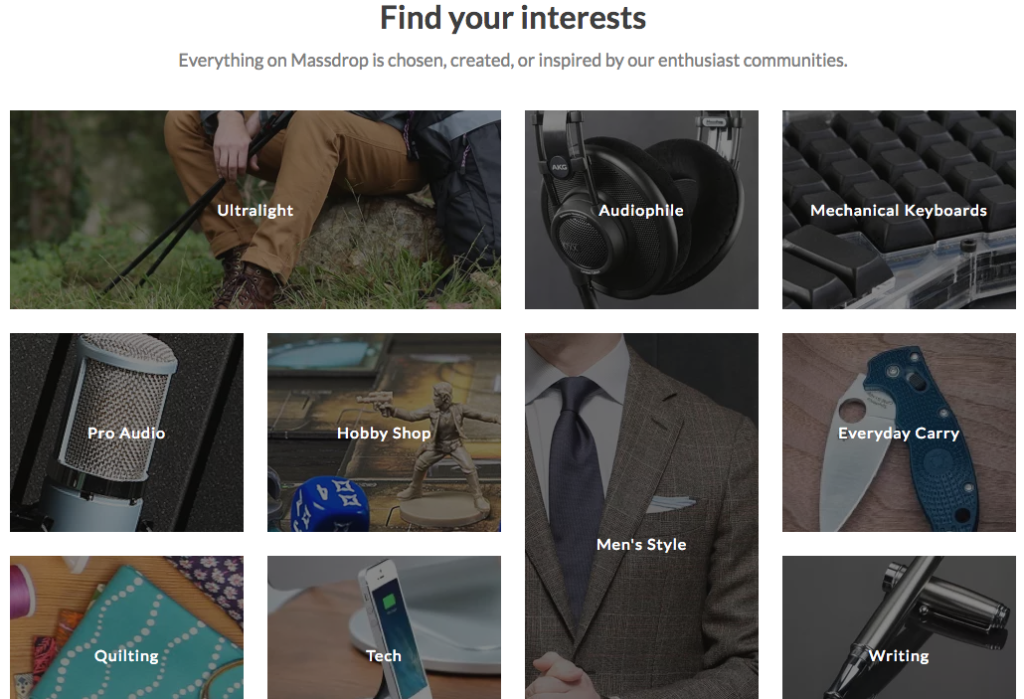

Earlier this week, Victorious, a publisher of more than 100 apps targeted to micro-communities of superfans, announced a $25M Series B round of funding. Six months prior, Massdrop, a platform that hosts dozens of transactional micro-communities around certain hobbies and products raised a $40M Series A from August Capital. Around the same time, Amino Apps, a creator of a wide range of interest specific forums raised its Series A from USV and Venrock. ReplyYes, a fast growing SMS-based curator for niche products recently expanded from targeting just vinyl enthusiasts to comic books fans, with more to come.

While this studio model of launches is commonplace in the gaming world, it’s a new development in the social category, and a reversion to an older model in commerce. It also appears to be a compromise of sorts (not a rejection) around the emergence of single purpose apps or vertical specific commerce – an affirmation that they do provide a benefit to end users, but an admission that on an individual basis their reward did not justify venture investment.

Around 2.5 years ago, I met a successful entrepreneur who had built a $200M revenue “category killer” business in the mid 2000s and believed he could build the same in what was otherwise a terribly noisy category. I was skeptical about the market but passionate about the entrepreneur and had him spend time with the entirety of our team. In selling the deal to my partnership, I focused on selling his operational excellence and impressive cash efficiency in spite of the headwinds in the space. But we passed, partially because of the market, but also partially because of the multiple business lines he was growing simultaneously – all interconnected, but each with unique marketing and operational challenges – which suggested to us a lack of clarity and focus.

That company is now doing extremely well, and our reason for missing the investment is because I failed to comprehend (and subsequently sell) his founding insight: that his niche specific competitors would quickly stagnate on growth and face increasing acquisition costs. That a category killer or roll-up strategy would likely win: enabling him to keep growth consistent & cash efficient and cross-market different brands to his existing, tangentially related customers.

I won’t make that mistake again.

Now that I’ve seen the roll-up/studio/category killer model begin to play out again in certain social and commerce categories, I’m still left wondering if or how it plays out in b2b SaaS, especially given the constraints around scaling up sales teams. I'll leave that as an open question for the future.